Yes, Facebook ads are tax deductible in Canada if they are used for business purposes. Like other online advertising expenses, you can claim them as deductions on your tax return to reduce your taxable income. But there are some rules and best practices to follow.

Table of Contents

What Are Tax-Deductible Advertising Expenses?

Advertising expenses include any costs you incur to promote your business. This covers both traditional methods like newspapers and billboards, as well as digital channels such as Facebook, Instagram, and Google ads.

The Canada Revenue Agency (CRA) allows you to deduct these expenses as long as:

- The ads directly relate to earning business income.

- The expenses are reasonable and documented.

For example, if you run Facebook ads to attract more customers to your online store, you can claim those costs. This also applies to design costs, like hiring a graphic designer to create your ad visuals.

How to Deduct Facebook Ads on Your Tax Return

Claiming Facebook ads on your taxes is straightforward if you follow these steps:

- Track Your Advertising Costs: Keep all receipts, invoices, and payment records from Meta (Facebook’s parent company). Use tools like Facebook Ads Manager to download your billing statements.

- Categorize the Expense: On your tax return, report these costs as “Advertising and Promotion” expenses. This falls under line 8520 of Form T777 (Statement of Employment Expenses).

- Transfer to Your Tax Return: After completing Form T777, add the total allowable expenses to line 22900 of your income tax return.

Pro Tip: Using accounting software like QuickBooks or Xero can help automate expense tracking and categorization.

GST/HST Rules for Facebook Ads (Maximize Tax Deductions)

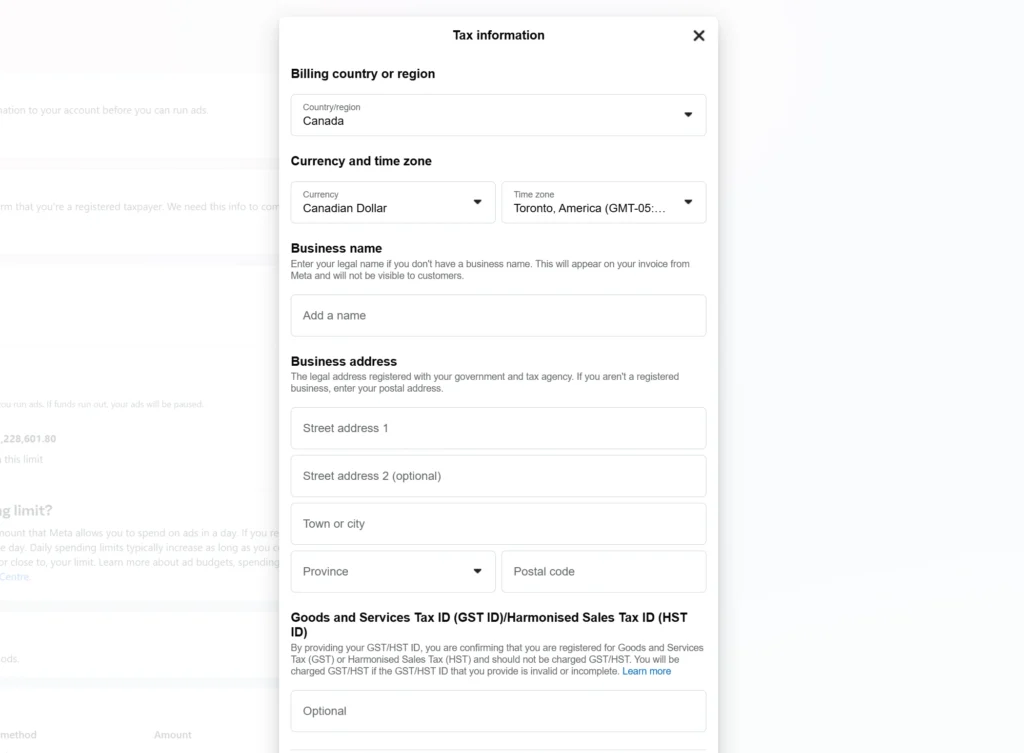

If you’re registered for GST (Goods and services tax) or HST in Canada, you can provide your registration number to Meta. This ensures you won’t be charged GST/HST on your ad purchases. Instead, you’ll self-assess these taxes when filing your GST/HST return, allowing you to recover input tax credits (ITCs).

Important: See the screenshot below where you can enter in your Business tax details.

What happens if you don’t register? Meta will add GST/HST to your ad costs, but you won’t be able to claim it back. This means higher expenses for your business—a good reason to register if your annual revenue exceeds $30,000.

Checklist: What You Need to Deduct Facebook Ads

- Meta Receipts and Invoices: Collect and store all billing records from Facebook Ads Manager.

- GST/HST Registration Number: Register your business and add your tax ID to your Meta account to avoid extra charges.

- Proof of Business Use: Keep screenshots of ad campaigns and performance reports to demonstrate they’re tied to business revenue.

- Categorized Expense Records: Use a Chart of Accounts or accounting software to organize ad costs under “Advertising and Promotion.”

- Form T777 and Line 22900: Complete these forms accurately when filing your taxes.

- Meta Receipts and Invoices: Collect and store all billing records from Facebook Ads Manager.

- GST/HST Registration Number: Register your business and add your tax ID to your Meta account to avoid extra charges.

- Proof of Business Use: Keep screenshots of ad campaigns and performance reports to demonstrate they’re tied to business revenue.

- Categorized Expense Records: Use a Chart of Accounts or accounting software to organize ad costs under “Advertising and Promotion.”

- Form T777 and Line 22900: Complete these forms accurately when filing your taxes.

Best Practices for Deducting Facebook Ads

If you are purchasing Meta Ads for business here are few things you would want to maximize your deductions and avoid audits:

- Keep Accurate Records: Store all Meta invoices, receipts, and contracts in a dedicated folder. Digital copies are fine as long as they’re legible.

- Document Campaign Objectives: Show how the ads directly contribute to your business revenue. For example, keep screenshots of your campaigns and analytics reports.

- Separate Business and Personal Use: If you use Facebook for both business and personal purposes, only claim the portion related to your business.

Pro Tip: Use Facebook’s built-in tracking tools to monitor ad performance. This data can justify your expense if CRA questions it.

Why Deducting Facebook Ads Is Smart

Let’s break it down with numbers. If you spend $5,000 annually on Facebook ads and your marginal tax rate is 30%, deducting these expenses could save you $1,500 in taxes. That’s money back in your pocket to reinvest in your business!

FAQs About Facebook Ads and Taxes

Q: Can I deduct Facebook ads if I’m self-employed?

Yes! Self-employed individuals can claim Facebook ads as a business expense, just like any other small business owner.

Q: Are personal Facebook ads deductible?

No, only ads used for business purposes are tax deductible. Personal or hobby-related ads don’t qualify.

Q: What about ads targeting international markets?

Facebook ads targeting customers outside of Canada are still deductible as long as they’re linked to your business revenue.

Final Thoughts

Facebook ads are a powerful tool for growing your business, and the CRA recognizes their value. By following the rules and keeping detailed records, you can deduct these expenses to lower your tax bill. Don’t forget to register for GST/HST if it applies to you—it’s an easy way to save even more.

If you’re unsure about any of these steps, consult a tax professional to ensure you’re maximizing your deductions. Tax season doesn’t have to be stressful—you’ve got this!